The Future of Cross-Chain Trading Is Here

Powered by Aori and LayerZero, Fast Swaps on Stargate are the fastest cross-chain swaps on the market & showcase the power of intents at scale.

Aori

9/17/2025

Cross-Chain Trading should feel as simple as sending a message: instant, intuitive, free.

Now it is.

Today, cross-chain trading is still a complete headache. Users face a frustrating web of bridges, gas fees, slippage, and confusing terminology just to move money onchain. This fragmented experience feels more like connecting the dots than trading.

Intents have promised a more natural path forward for some time and it’s not hard to see why. Users only declare what they want (e.g., "I want 4500 USDC on Arbitrum for my 1 ETH on Ethereum") without specifying how to achieve it.

Until now, intents have struggled to truly scale. Users dealt with long settlement times, unpredictable pricing and the persistent risk of failed or slow execution.

Some improvement.

Trading across chains should feel like sending a message: instant, intuitive and free.

Now it does.

Today we’re proud to announce Fast Swaps on Stargate - powered by Aori and LayerZero.

Why Cross-Chain Trading Still Feels Broken

Cross-chain swaps have become more common as users’ crypto portfolios have become diversified across chains and ecosystems. However, the infrastructure needed for reliable execution and a seamless UX has yet to catch up.

Beyond the infrastructure itself, cross-chain swaps today are effectively bridges with an additional swap at the beginning and/or end of the transaction. This “swap-bridge-swap” rhythm forces users to set incredibly high slippage rates due to the volatility of the assets they are swapping.

Slippage is just one of the market inefficiencies plaguing users today. MEV, front-running and variable block times add further friction by creating another layer of execution risk. Overall, current on-chain UX falls short of standards users expect in tradfi and ultimately throttles crypto adoption overall.

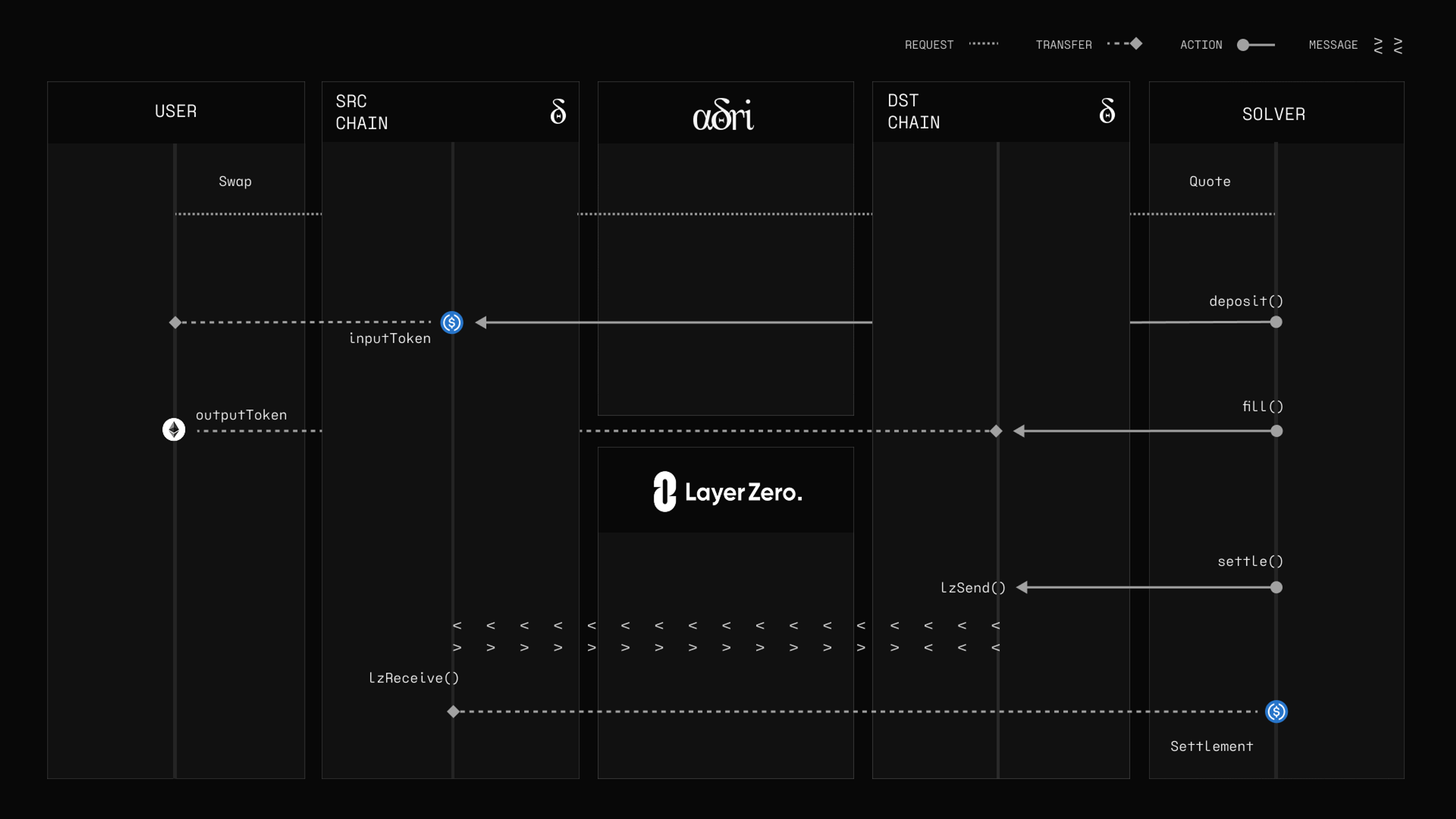

How Aori Works

Aori overcomes the challenges of cross-chain trading with a hybrid execution model that combines off-chain matching with on-chain settlement. Intents are created and matched in a low-latency environment off-chain, while LayerZero ensures atomic settlement across chains, preserving the security and censorship-resistance of blockchains. By decoupling order matching from consensus bottlenecks, Aori enables continuous execution without waiting for block confirmations. This eliminates slippage, front-running, and unnecessary gas costs for placing or canceling orders.

Settlement is designed for efficiency, with multiple trades bundled into a single transaction, and Aori’s smart contracts on each chain verify intents and manage balances, delivering scalable, trustless infrastructure for both retail and institutional-grade users.

Aori’s layered architecture leverages distinct but coordinated execution and verification components. Users express trading intents through signed orders using EIP-712 structured data, specifying input/output tokens, amounts, chains, timing constraints, and participant addresses.

Our smart contracts act as the verification and accounting layer, ensuring that orders are filled according to their signed parameters while managing balance states that are later settled across chains.

LayerZero-Powered Settlement

When a solver fills a cross-chain order, they execute the deposit on the source chain and provide output tokens on the destination chain. Settlement is then decoupled but remains atomic from the user’s perspective. Solvers batch multiple fills into one LayerZero message, reducing per-order costs.

The destination chain contract packages proofs of all fills and sends them back to the source chain, which validates and credits solvers. This batching mechanism amortizes costs across many orders, enabling high-frequency trading functionality which is currently impossible with bridge-per-transfer models.

This batching mechanism is a perfect example of how LayerZero’s messaging infrastructure enables intent scalability. By amortizing LayerZero's fixed message costs across multiple orders, Aori can achieve marginal costs low enough to support high-frequency cross-chain trading - something impossible with traditional bridge-per-transfer models.

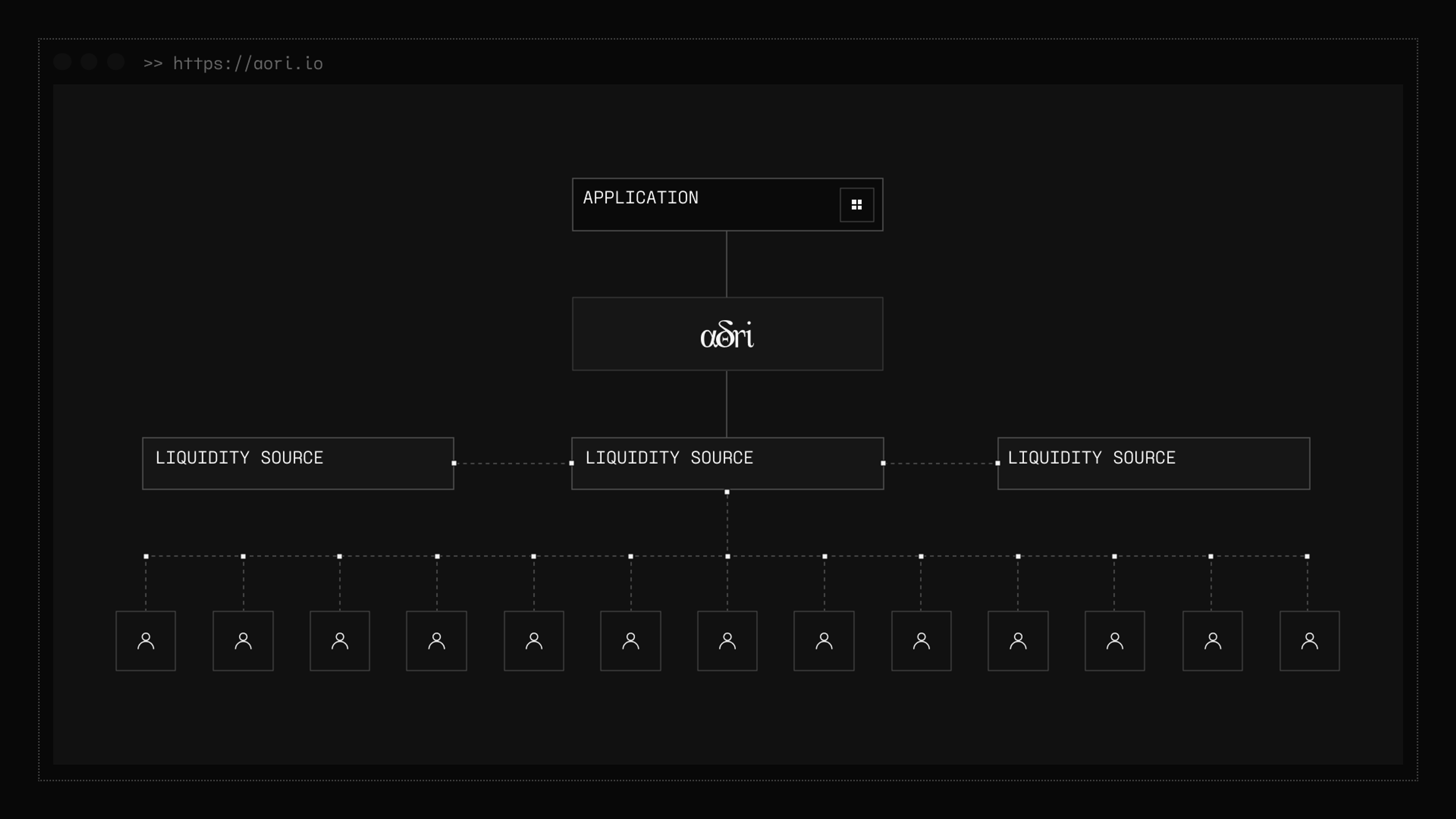

The Universal Liquidity Layer

Aori is a liquidity-agnostic execution layer that aggregates depth and pricing from any on-chain or off-chain source - AMMs, CEXs, solver networks, order-flow auctions, cross-chain pools, and beyond - into a single, ultra-low-latency liquidity pool. Using Omnichain Fungible Tokens (OFTs), solvers can seamlessly move assets across chains, collapsing fragmented markets into deeper, tighter, and more predictable execution.

Hooks extend this flexibility by running smart contracts during order processing, enabling advanced strategies like DEX aggregation, slippage protection, and instant integration of new liquidity sources without protocol upgrades.

This extensibility means that as new liquidity sources emerge or as OFT adoption grows, solvers can immediately incorporate these improvements without requiring protocol upgrades. The universal liquidity vision isn't just about token availability - it's about having a flexible architecture that can adapt to and benefit from the broader omnichain ecosystem.

Speed + MEV Mitigation

Aori's MEV protection stems from a fundamental design choice: all orders use limit pricing, meaning users specify exactly the minimum output they're willing to accept. This atomic settlement provides strong MEV protection. Unlike traditional swaps that sit in public mempools awaiting execution, Aori orders are fulfilled privately by solvers who internalize the execution complexity. The solver handles any necessary DEX routing off-chain or through private execution, then delivers the guaranteed output directly to the user.

The result is that users never experience sandwich attacks or frontrunning because there's no public pending transaction to exploit. The solver's commitment to the limit price, enforced by smart contract logic, ensures users receive exactly what they signed for, no less. Combined with the speed of off-chain matching, this creates a MEV-resistant environment where users get predictable execution without having to become MEV experts themselves.

Permissionless Composability

Aori is fully permissionless. They enable teams to integrate additional services directly into their frontend, enhancing functionality and UX. From multi-step arbitrage, cross-protocol lending, or portfolio rebalancing and tokenized perps, Hooks empower developers to innovate and expand their dApps without being limited by the underlying blockchain architecture or interoperability.

The complexity remains hidden. Users just sign one intent. Solvers and hooks handle execution, LayerZero handles settlement, and the experience feels instant.

The Future is Already Here

Want to see all this in action? Fast Swaps on Stargate are live today powered by Aori & LayerZero turning scalable intents from an abstract idea into a reality.

Any dapp, wallet or protocol can integrate Aori, giving users instant, efficient, MEV-resistant cross-chain swaps without the complexity of bridges or lockups. The promise of intents has finally arrived, and it is available now.